#Morningenergy Good morning dear friends~~

9/27/2017

9/26/2017

#Morningenergy September 26, 2017

#Morningenergy Good morning dear friends~~~

This is @yikeshuoffice . I will update our product at here. Welcome follow me. Have a nice day!

This is @yikeshuoffice . I will update our product at here. Welcome follow me. Have a nice day!

9/25/2017

#Morningenergy September 25, 2017

#Morningenrgy Good morning guys~~

Today, give a stranger one of your smiles. It might be the only sunshine he sees all day.

Today, give a stranger one of your smiles. It might be the only sunshine he sees all day.

9/21/2017

9/20/2017

9/19/2017

9/18/2017

9/15/2017

Markets Update: Bitcoin Breaks Below $4000 During 12% Sell-Off

Bitcoin has broken below $4000 USD following a sudden 12% sell-off. The dump occurred following the establishment of a third point of contact on a descending trendline from the all-time high of approximately $5000 USD, amidst speculation that China’s government may move to suspend the operation of some Chinese bitcoin exchanges.

The bitcoin markets are again testing the $4000 USD support area following a 12% drop, with prices currently hovering between approximately $3900 and $4000. The dip appears to have been triggered by rumors that China’s government will temporarily suspend the operations of all Chinese cryptocurrency exchanges coupled with the establishment of a third point of contact on a descending trendline from the recent all-time high of approximately $5000 USD.

The dip comes after a choppy fortnight of consolidation between the $4000 – $4500 USD area. The consolidation yielded several significant bullish indicators, likely contributing to yesterday’s sell-off. Notably, the bounce from $4000 USD to $4600 USD that immediately followed the retracement from $5000 USD produced signs of bearish volume divergence.

Much of the recent selling has been influenced by uncertainty pertaining to Chinese bitcoin exchanges, amidst rumors that the central government may move to suspend the operations of all cryptocurrency exchanges in China. Charlie Lee has posted on Reddit stating that a trusted anonymous source has confirmed the rumor. At present, it appears as though Chinese bitcoin exchanges will likely close operations for a brief period of time whilst the government clarifies its regulatory position.

Bitcoin cash appears to have broken from an inverse correlation with bitcoin in recent weeks, having shed approximately 12% of its dollar value during yesterday’s dip in btc price. BCH is currently testing the $500 USD support area.

Litecoin has also undergone a significant retracement, with price action currently hovering at approximately $62.50 following LTC’s recent rally that established a new all-time high of approximately $91 USD.

Do you think that the markets will continue to dump if the rumor is officially confirmed, or are you expecting price to bounce off the $3900-$4000 area?

#Morningenergy September 15, 2017

#Morningenergy Good morning everyone~~~

The farther backward you can look,the farther forward you will see.

The farther backward you can look,the farther forward you will see.

@ https://www.facebook.com/iyikeshu/

9/14/2017

Why Bitcoin is Not a Bubble?

The internet is replete with people referring to bitcoin as a “bubble.” They are spreading fear, uncertainty, and doubt galore. They believe bitcoin’s high price spells impending doom, but their criticisms move beyond mere skepticism. It seems like they just hate cryptocurrency. Yet many of these pundits do not fully grasp bitcoin…or even economics.

Bitcoin is special. It is not a company that could lose profitability and fail. It is certainly not a speculative real estate scam that could crumble as a result of government and bank-induced chicanery. Bitcoin is another animal.

Its value is not increasing because of marketplace lies. It is increasing because it is a life-changing financial invention. It is increasing because more people are adopting it. The “network effect” is in full swing.

It is true investors are rabid to get on board and this excitement is causing bitcoin’s price to explode, but do not confuse this with an artificially inflated bubble based on a “false truth.” In accordance with the network effect, the more people that continue to get involved with bitcoin, the higher the price will climb.

Bitcoin is also growing as a result of basic economics. The supply is limited to 21 million units and this necessarily makes bitcoin a scarce asset. When things are scarce and people want those things, their value will ultimately rise. Supply and demand at work.

Thus, when economics and the network effect intermingle, you have a recipe for explosive growth within an asset. Bitcoin is not some new version of the 17th century tulip bulb. It is a groundbreaking advancement in accounting and money.

Bubbles versus Technological Failures

With that said, this does not mean Bitcoin is guaranteed to succeed. The price could be affected if something bad were to happen to the protocol that underlies it. If this kind of event ever occurred, people would certainly lose faith in bitcoin and its price would collapse.

However, this is not the same thing as an artificially hiked price or “bubble.” It is the result of a technological or community failure, but not a market failure. For instance, Bitcoin just upgraded to Segwit. However, Segwit does not necessarily align with Satoshi Nakamoto’s vision that Bitcoin should be a scalable, peer-2-peer cash system. Instead, it turns bitcoin into a settlement layer, which could do harm to the currency.

This illustration is not intended to spread panic. I am just saying bitcoin is susceptible to failures and crashes. It is just that these potential crashes are not the result of a “bubble.” They would occur because the community failed to make bitcoin economically viable. In either case, many people hope Segwit will work over the long run and that there will not be a technological failure.

Why do people believe bitcoin is a bubble? How big will bitcoin actually grow?

9/13/2017

9/12/2017

Lead Developer Amaury Séchet Discusses the Future of Bitcoin Cash

This week the lead developer of Bitcoin ABC, Amaury Séchet, engaged in a Reddit Ask-Me-Anything (AMA) discussion about the future of Bitcoin Cash (BCH), and the protocol’s future scaling.

An AMA With Amaury Séchet – Lead Developer of Bitcoin ABC

This summer Amaury Séchet (otherwise known as ‘deadalnix’), the lead developer of the Bitcoin ABC client, revealed the team’s intentions at The Future of Bitcoin event to hard fork the Bitcoin network on August 1. Since then Bitcoin Cash has been thriving, and Séchet recently explained his vision for the future of the BCH chain and the ABC client. Many other BCH supporters and developers were involved in the conversation with Séchet including Yours network founder Ryan X Charles, Openbazaar’s Chris Pacia, Bitcoin Classic’s lead developer Thomas Zander and others.

A Configurable Block Size and Finding the Right Fee Structure for Bitcoin Cash

Participants asked Séchet questions concerning the current roadmap for bitcoin cash; such as future block sizes, BCH and BTC compatibility, and protocols like layer two solutions. For instance, the developer of the Electron Cash wallet, Jonald Fyookball asked the ABC developer what he thinks about “algorithm-based block size” solutions. Séchet explains the BCH block size can be configurable using the protocol in the ABC client.”

“I like these proposals,” explains Séchet. “Right now the block size is configurable in ABC, but I would like to have a way to determine this configuration automatically in the future.”

Yours network developer, Ryan X Charles, asks Séchet how the protocol can avoid ‘dust limits’ and fee management. “We [Yours developers] run into dust limits quite easily,” Charles explains regarding the software’s recent implementation of bitcoin cash.

“There is work to be done on fee management,” Séchet responds. “Finding the right fee structure will take time, if one exists at all.”

The next version of ABC will reserve a percentage of the block space for low fee transactions. This will improve over time.

9/11/2017

Japan’s Internet Giant GMO Launching Bitcoin Mining with 7nm Chips

Japan’s leading internet conglomerate and bitcoin exchange operator GMO has announced that it is expanding into the businesses of bitcoin mining and chip manufacturing. The company revealed plans to produce and sell 7nm semiconductor chips and run a mining facility in Northern Europe.

GMO’s Venture into Mining Business

GMO Internet Inc, announced on Thursday the launch of a bitcoin mining business, “utilizing the next-generation 7nm semiconductor chip.” The company wrote:

We will operate a next-generation mining center utilizing renewable energy and cutting-edge semiconductor chips in Northern Europe. We will use cutting-edge 7nm process technology for chips to be used in the mining process, and jointly work on its research and development and manufacturing with our alliance partner having semiconductor design technology.

Headquartered in Tokyo, GMO offers a comprehensive range of internet services worldwide. Its internet infrastructure business has 8.47 million customers and ranks number one in Japan. The company is listed on the Tokyo Stock Exchange.

GMO Group consists of 129 entities as of the end of July this year. One of its subsidiaries is GMO Coin Inc, who offers digital currency trading and digital currency fx trading. It was launched on May 31, and then changed its name on August 9 from Z.com Coin Co., Ltd. The company wrote:

By entering this project, GMO Internet will support the sound operation of bitcoin which is ‘the worldwide common currency’ .

#Morningenergy September 11, 2017

#Morningenergy Good morning Monday~~~

Love is like an hourglass, with the heart filling up as the brain empties.

@ https://www.facebook.com/iyikeshu/

Love is like an hourglass, with the heart filling up as the brain empties.

@ https://www.facebook.com/iyikeshu/

9/08/2017

#Morningenergy September 8, 2017

#Morningenergy Good morning Friday~~~

I would like weeping with the smile rather than repenting with the cry.

@ https://www.facebook.com/iyikeshu

I would like weeping with the smile rather than repenting with the cry.

@ https://www.facebook.com/iyikeshu

9/07/2017

Segwit-Compliant Python 3 Bitcoin Library ‘BTCpy’

This week the bitcoin software startup Chainside released a new Python 3 Segwit-compliant Bitcoin library called “BTCpy.” The company hopes the new codebase will further blockchain development and that businesses can integrate Bitcoin software with ease.

Introducing BTCpy – a New Python 3 Segwit Compliant Bitcoin Library

Chainside is blockchain protocol company that specializes in bitcoin development for businesses looking to integrate the digital currency into their daily operations. On September 3 the startup launched BTCpy which aims to provide a “simple interface to parse and create complex Bitcoin scripts.”

“Differently from other existent Bitcoin libraries, BTCpy is able to recognise and create arbitrary scripts in a simple fashion, something particularly important to develop Layer 2 applications, where complex smart contracts with time-locks, hash-locks and if-else clauses are needed,” explains Chainside’s CTO Simone Bronzini.

‘Tools Like BTCpy to Abstract Complexity Are Needed’

Bronzini says that during the scaling debate some proponents prefer to keep Bitcoin software simple but solutions like Segwit and Lightning Network can be complicated processes. “We believe that for the long term success of Bitcoin the best technical solution is always preferable, but tools like BTCpy to abstract its complexity are needed,” Bronzini’s announcement details.

Further the startup says while others keep libraries like this private for company use only Chainside felt the best thing to do was to release the codebase to the open source community. The codebase and protocol instructions can be found here on Github and the software is in its very early stages. Presently it is highly discouraged to use it in a production environment explains Chainside.

Chainside still has to add support for Segwit addresses (BIP173), deploy caching to segwit digest computation to avoid quadratic hashing, and many other improvements mentioned in the team’s roadmap.

What do you think about BTCpy? Do you think libraries like this one is helpful for development? Let us know in the comments below.

订阅:

评论 (Atom)

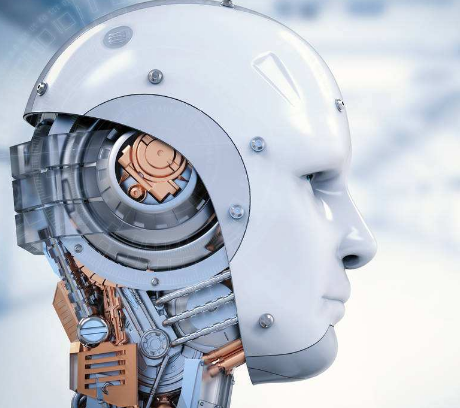

Robot shopping guide wins over real person shopping guide by nearly 90% of users welcome

To the person that loves shopping, a good guide is bought be like close close small boudoir honey, let a person be like mu chun feng, enjo...

-

I think we all have some understanding of capacitors , from the objective point of view, capacitors in a sense, has been similar to the b...

-

On September 27th, the intelligent portable robot Wukong launched by Tencent and Diantong was officially released. As the industry's fi...

-

TE Connectivity (TE), a global leader in Connectivity and sensing, offers high-speed plug-in I/O copper cable assemblies that support the...